VimpelCom is a publicly traded company (NYSE symbol VIP), with the Russian Alfa Group controlling 32 percent and the Norwegian telecom Telenor controlling 27 percent of voting stock -- Alfa Group also owns 13.2 percent of Turkcell (NSE symbol TKC) which owns 41 percent of Fintur which owns 65 percent of Azercell (see here page 115). As for OTE, which is also publicly traded (NYSE symbol OTE), the Greek government controls about 39 percent of it but is planning to sell its stake in June 2007. VIP and OTE, on a pro-forma basis, were very profitable last year and during the first nine months of this year, and both have a market capitalization of about USD 16 billion.

This transaction is bound to have implications for commerce, consumer welfare, and tax revenues among others. Unfortunately, such analysis is not reported in the press, nor undertaken by academic circles and think-tanks in Armenia. What is even more sad is that western-funded organizations and analysts have also failed to provide meaningful analyses as well (see the back-to-back articles by Emil Danielyan and Vladimir Socor writing for the Jamestown Foundation). Of course, telecom and finance related outfits around the world have provided ample coverage on the transaction, as both OTE and VimpelCom disclose much of their activities to the US Securities and Exchange Commission (see here) as well as on their websites (www.ote.gr and www.vimpelcom.com). [See here for a detailed description of Armentel’s finances in Armenia.]

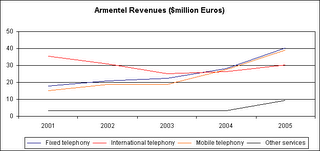

I am not an expert on IT, telecom, or the tax ramifications of this transaction. But I am hoping to jump start some discussion of its effects. For starters, fixed lines account for 34 percent of Armentel’s earnings (about 600,000 subscribers). Would VimpelCom continue to provide fixed telephony services or would it divest given its lack of experience? And if it divests, what would this mean for competition and pricing?

About 26 percent of revenue is derived from international calls. Surely VimpelCom would benefit from this stream of revenues, but one wonders how the recent acquisition of Callnet (75 percent stake) by the Russian Comstar-UTS (USD 2.6 billion market capitalization) could affect the market (see here). Callnet earned USD 4.3 in revenues in 2005, so it is very small. But given that it holds an ILD license for international calls, the prospects of real competition might be pretty good with this takeover. Also, its subsidiary Cornet is a sole provider of WiMax services in Armenia. Comstar-UTS (LSE symbol CMST), which made recent acquisitions in Ukraine, is controlled by AFK Sistema which also controls 53 percent of MTS, Russia’s largest mobile company which lost the bid for Armentel. (See here, page 14, for a list of the bidders for Armentel).

Mobile telephony accounts for a third of the revenues of Armentel, which has grown in importance over the years. The number of its subscribers in Q3’06 was 441,716, up 46 percent from the same period in 2005. The entry of VimpelCom, with its presence in neighboring Georgia, Ukraine, Russia, and Central Asia, could stiffen competition in this rapidly expanding market -- the Lebanese owned VivaCell is believed to control 60 percent of the market (this number is commonly used but strikes me as way too high -- can anyone confirm?). Also wireless internet may receive a significant boost.

OTE expects the sale of Armentel to generate a pre-tax gain of 292.9 millions euros (see here page 11, and here page 25). The amount reported for tax purposes could be different depending on the book-tax conventions employed by OTE. I know that Armentel's tax rate is only 10 percent (half the 20 percent profit tax rate -- due to tax incentives). Not sure if this tax rate or a withholding tax rate on repatriated gains would apply. Hopefully the tax authorities will not repeat past mistakes. [In 1998, OTE bought 90 percent stake in Armentel which was jointly owned by Trans-World Telecom (TWT), registered in Guernsey, and the Armenian government. In 2000, the government imposed tax and penalties of about USD 12 million on OTE for gains accrued by TWT. The treatment of OTE was inept and very unprofessional. Let’s hope this time they tax the entity that accrued the gain, i.e. OTE and not VimpelCom. On a related subject, has anyone done any research on whether it was a mistake for the Armenian government, which owned 51 percent of Armentel, to hold on to 10 percent of the shares and dilute its majority interest at the time of its sale in 1998?]

I know I have way too many questions. But it will be good to hear any opinions out there.

10 comments:

Congrats on the blog. Just found it via another site. Good to see such a specialist blog set up. Looking forward to reading more.

Thanks Onnik.

The most difficult aspect of this exercise is getting data on economic activity in Armenia. With the help of my former students at Yerevan State University and others in the US, we have built a new website www.aea.am where economic databases, among others, are posted. But it is an uphill battle.

Great blog David.

I think IT and High Technologies in general (and at some extend pharmaceuticals) are the future of Armenian Economy. As it enables to produce products and services which are not bulky and cost effective to transport comperingthe value over the size/wight. It also doesn’t require much resources and raw materials that Armenian lacks. The beauty in IT is that it changes the foundamenta Economics rules of (Resources are scares, wants are infinite because information has no boundaries and no limits). The 3 major resources for IT that are required are: brainpower, equipment and communication channels. I don't see a problem with the first two as IT is a tradition starting from 60s and it is not hard to get new equipment however I see problem with the communications. Bad communication i.e. internet, is the same as no or bad roads. As Armenia I Landlocked and have theoretically in blockade or under the threat any second then our only hope is to establish high speed Telecommunications to facilitate effective and quality information sharing and distribution. Internet is not only vital in uploading or downloading data but it helps to work on remote systems.

Here where Armentel/VimpelCom come. We all know the failure and short-sightedness and at some extend the ‘tgitutyun’ ( I prefer to use an Armenin word here as it describes it the best) of Armenian officials to agree a beneficial agreement with Armentel which will passed to VimpelCom. Will we ever be able to come out of this mass? If the Russian government has influence over Vimpelcom then I doubt we will because Russians are not interested in seen Armenian economy developing and modernising.

The stories of giving 10% of government owned shares for revision of the contract are mere ways of dropping the responsibility, keeping the Russian happy and getting personal cut in the deal.

However there are still alternative ways out of it.

Granted that Armentel's monopoly is passed on to Vimpelcom, do we know how the recent takeovers will affect the internet? Would Vimpelcom control internet links with the outside world? Would armenia still rely on lines that run at the bottom of the black sea? Would Callnet's international long distance license affect things (how did it get this -- thought Armentel had a monopoly)?

This deal is by far a better news than not. VimpelCom is a better match as corporate parent than OTE. ArmenTel will grow faster, as it siezes to be a subsidiary "island", such as it was for OTE and most likely will grow to become an extension of VimpelCom's operations southbound. ArmenTel will grow faster, financially and operationaly. The problem with this deal, as it is with most other deals in Armenia, is that it is more of a political transaction than ecomonic. While OTE bought the company paying under $100 million in mid-1990s, and now VimpecCom bought it for several times more, nobody in Armenia benefited, directly and financialy that is. Both sales took place in secrecy, with almost no transperency, and intermidiaries where politicians, not investment bankers. A several hundred million dollar deal went down without investment bankers. No "fairness opinions", no Goldman Sachs or Morgan Stanley. Not even Troika Dialog. Why was Troika Dialog not involved in the deal, as it was involved in many deals for Vimpelcom, including its IPO and other deals. Armenia is by far lagging in having bankers and lawyers putting deals together. That is why all sales are not conducted to the fullest potential. The same was the case for Vivacell and MTS, which took place several months later.

In the matter of Trans-World Telecom (TWT), one should ask the most simple question: how did a company, without any diclosure of ownership, demociled in offshore jurisdiction, ended up with a sizable ownership in the company with the highest strategic implication, the national telecom. All other questions, such as who onws it, how much did "they" pocket from this, is secondary. The most disturbing is that till now nobody in Armenia is asking a question regarding TWT. Presence of entities such as TWT, and true owners behind entities such as this, is the reason why no deal has gone down in Armenia with any reputable company, such as Morgan Stanley, Goldman Sachs or Paribas acting as advisor. No fairess letter would be issued by them, with TWT on the scene and its owners lurking in the backstage. I think US SEC should ask quesions to OTE, demand expalianation of the extend OTE aided and abated corruption.Shareholder of the company should ask the same question. Rand or Kroll could easily identify the true beneficial owners of TWT.

Artak,

The deal is between Moscow and Athens; Yerevan has little to do with it. Also it is a private deal between two companies listed on NYSE, and there is no need to get an intermediary, Troika or otherwise.

i quote from a study by Rimma Urumyan:

"The Ministry of RA Transport and Communication performs local, international and other telecommunication services’ provision licensing and arrangement of issues related to it in the territory of RA. Due to the Foundation Contract of October 1st, 1994, “ArmenTel” JV CJSC was founded for exploiting and developing Armenian local and international telecommunication networks and for providing telecommunication certain services in RA.

“ArmenTel” JV CJSC was obliged to provide telecommunication in the whole territory of RA, to perform digitalization in Yerevan and in RA 800 villages.

To date, contrarily to what we can read on Armentel.com website

ArmenTel has started the improvement of the telephone network in Armenia since the first day of its creation.

In 2005 the exploited digital capacity in Yerevan was increased by 24.200 subscriber line capacity and in RA marzes –11.000 subscriber line

In Yerevan

Extension of 43/45 digital switch with 4.200 subscriber line capacity

New digital 63/64/66 switch with 63/64 index with 20.000 subscriber line

Extension of T-A Center, T-C Ajapnyak and Amiryan digital switches with total 7.400 subscriber line capacity

http://www.armentel.com/eng/fix/fixhist.htm

the digitization of switch 43/45 is still a lightful promise...

1/When will Erebuni, first capital of Armenia, access fixed digital internet?

2/When is fix telephony monopoly ending for (Armentel)?

thanks

Hello David,

You know about my work with the World Bank, and although I have not looked at Armenia's telecom sector in detail, I have always considered the re-structuring and increased valuation to be in response to the need to maintain and annually increase FDI, which as you know has been the backbone of Armenia's fabricated but now rapidly failing economic boom.

I am interested to see how the investments, capitalization and revenues of Armenia's telecom sector compares to other telecom organizations such as Orascom telecom, which has 430 million subscribers and a revenue of $4.72 billion (2007). Have you done any work on this?

Thank you for providing this interesting article and the links.

Hi Bruce,

Data on telecom investments in Armenia can be obtained from armstat (aggregated) or from the individual companies (annual reports or 10-K filing with the US SEC). I have not done that comparison but I am still hoping someone will do it!

Post a Comment