The opening of the new arrival wing of the Zvartnots airport, designed to handle 2 million passengers annually, represents the culmination of a dazzling growth and expansion in air transportation in Armenia.

Indeed, the number of passengers arriving in Armenia nearly doubled to 575,000 in 2005 up from 293,000 in 2000 (see below and check here and here for more details).

2000 292,800

2001 375,900

2002 434,000

2003 458,500

2004 559,100

2005 574,700

Similarly, the number of foreign airlines carrying passengers to and from Yerevan has expanded dramatically as well. In 1994, an Air France weekly charter flight was the only hope for a westerner of making it to the country. Today, there are daily flights that connect passengers from four corners of the world to Armenia. Passengers have the choice of Air France, Austrian Airlines, British Airways (Med), Czech Airlines, Lufthansa, and Aeroflot, in addition to Armavia (armenian airlines), that make it possible to fly into Yerevan on any day of the week. Amsterdam, Frankfurt, London, Moscow, Munich, and Paris, among others, provide travelers to and from Armenia access to the world’s premier airlines and destinations.

The changing face of air traffic is impressive, particularly when compared to that a decade ago. The flight patterns show a marked orientation to the west. But they also reflect Armenia’s sprawling Diaspora (see here). Destinations to various cities in Russia and other parts of the former Soviet Union, as well as those to the Middle East, in many ways highlight the ties that keeps Armenians connected.

Notwithstanding the experience in passenger traffic, air cargo shipments have yet to take off. For the years 1999 through 2004, for instance, exports and imports tonnage totaled (check here): 13.5, 13.8, 11.4, 8.4, 8.7, and 9.2 only. (please help update this and other data sources). Is this a resource waiting to be tapped? Clearly, the composition of exports today makes very little demands on the airline industry (see here). But shouldn’t this composition itself evolve to reflect the availability of air transport?

Also, the seat factor is increasing but was about 68 percent in 2003 (see here). Recent figures may be higher. Nevertheless, it looks like planes are flying 30 percent empty. There are also significant flight delays – more than a third of all flights (see here).

Has anyone undertaken a study of the airline industry? This is an industry highly critical to the prosperity of the Armenian economy.

[Please write me if interested in contributing]

Tuesday, September 26, 2006

Sunday, September 24, 2006

Market Concentration

A recent report by RFE quotes an Armenian businessman and a member of the parliament complaining about the lack of "free enterprise and fair competition in the country." This is despite the fact that Armenia is ranked as the 27th, far ahead of many countries, by the Heritage Foundation and the Wall Street Journal index of economic freedom.

The big question is how much market concentration is there in Armenia. This is important as it reflects on the degree of competition (and monopoly power) in the economy. Do we see this in the data? Has anyone done any comprehensive study, sector by sector, on how many firms there are in each sector, and their market share? I know that some are concerned about the extent of ownership and control by certain government officials, but that is a secondary question. It is more critical to explore whether the existing market structure hinders economic growth and hurts consumers.

The clearest signal of lack of competition, albeit not always perfect, is the price wedge between similar Armenian and foreign goods and services. Armentel might be a good case in point, but at least it paid in advance for this monopoly right. Another example is the government's favoring Armenian over foreign airliners (e.g., much better hours of arrival and departure). Of course, legal monopolies and the protection of domestic industries have their costs, regardless of the motivation and transparency. But other more egregious forms of market control can be far more damaging to the economy and prosperity of the country. One example is the rumored shortage of jet fuel which has allegedly caused delays and cancellations of flights earlier in the year.

So, again, the question is whether we know of any studies on market concentration. If not, is anyone out there aware of any data sources that could be explored to undertake such study?

The big question is how much market concentration is there in Armenia. This is important as it reflects on the degree of competition (and monopoly power) in the economy. Do we see this in the data? Has anyone done any comprehensive study, sector by sector, on how many firms there are in each sector, and their market share? I know that some are concerned about the extent of ownership and control by certain government officials, but that is a secondary question. It is more critical to explore whether the existing market structure hinders economic growth and hurts consumers.

The clearest signal of lack of competition, albeit not always perfect, is the price wedge between similar Armenian and foreign goods and services. Armentel might be a good case in point, but at least it paid in advance for this monopoly right. Another example is the government's favoring Armenian over foreign airliners (e.g., much better hours of arrival and departure). Of course, legal monopolies and the protection of domestic industries have their costs, regardless of the motivation and transparency. But other more egregious forms of market control can be far more damaging to the economy and prosperity of the country. One example is the rumored shortage of jet fuel which has allegedly caused delays and cancellations of flights earlier in the year.

So, again, the question is whether we know of any studies on market concentration. If not, is anyone out there aware of any data sources that could be explored to undertake such study?

Tuesday, September 19, 2006

Economics and Finance Education

Reading the plan for the construction of the new Moscow School of Management with a price tag of USD 70 million in today’s Financial Times, brought to mind the dire situation Armenia finds itself in. In particular, the statement that “While Russian universities have a powerful academic reputation in the sciences, they have no history in teaching western-style management” hits home. More to the point, there is no history of teaching economics and finance in Armenia, and no one seems to be aggressively promoting academic excellence there.

Last October, when I taught economics in Yerevan, I was struck by the lack of textbooks in most if not all areas of economics, finance, business, actuarial sciences, among others. Textbooks didn’t really exist at both undergraduate and graduate levels. For the graduate level, and for those with advanced training in math and are fluent in English, students may tap into online lecture notes and textbooks available from the servers of a number of universities around the world (check AEA). Software such as Matlab and Mathematica commonly used in the teaching of advanced economics simply do not exist. At the undergraduate level, only a couple of textbooks have been translated into Armenian. Not only students are handicapped by the lack of textbooks and training materials, but the situation is further aggravated with official faculty salaries well below USD 200 per month.

It is not that funding is lacking, but that these funds are seldom diverted to improve the educational standing of academia. Tens of $millions have been spent on tax reform and tax administration projects. Yet there is not a single public finance textbook in the country. Millions are poured into the banking/financial sector, yet finance/corporate finance textbooks don’t exist. Similarly, no textbooks are available in the actuarial sciences despite the ongoing pension reforms. For those undergraduates with the means and fluency in English, getting over the lack of textbooks may not be an insurmountable task. But what are the majority remaining students, and their faculty, supposed to do. For those graduating undergraduates interested in an MBA, the American University of Armenia is perhaps the way to go. But otherwise, there is much to be done to raise the quality of training and funding of faculty and academia in all the remaining fields (see assessment).

Today’s students are the future leaders in commerce and finance of Armenia. One would hope that those present at the ongoing Armenia-Diaspora Conference are paying attention.

Last October, when I taught economics in Yerevan, I was struck by the lack of textbooks in most if not all areas of economics, finance, business, actuarial sciences, among others. Textbooks didn’t really exist at both undergraduate and graduate levels. For the graduate level, and for those with advanced training in math and are fluent in English, students may tap into online lecture notes and textbooks available from the servers of a number of universities around the world (check AEA). Software such as Matlab and Mathematica commonly used in the teaching of advanced economics simply do not exist. At the undergraduate level, only a couple of textbooks have been translated into Armenian. Not only students are handicapped by the lack of textbooks and training materials, but the situation is further aggravated with official faculty salaries well below USD 200 per month.

It is not that funding is lacking, but that these funds are seldom diverted to improve the educational standing of academia. Tens of $millions have been spent on tax reform and tax administration projects. Yet there is not a single public finance textbook in the country. Millions are poured into the banking/financial sector, yet finance/corporate finance textbooks don’t exist. Similarly, no textbooks are available in the actuarial sciences despite the ongoing pension reforms. For those undergraduates with the means and fluency in English, getting over the lack of textbooks may not be an insurmountable task. But what are the majority remaining students, and their faculty, supposed to do. For those graduating undergraduates interested in an MBA, the American University of Armenia is perhaps the way to go. But otherwise, there is much to be done to raise the quality of training and funding of faculty and academia in all the remaining fields (see assessment).

Today’s students are the future leaders in commerce and finance of Armenia. One would hope that those present at the ongoing Armenia-Diaspora Conference are paying attention.

Friday, September 15, 2006

Foreign Investments in Armenia

Foreign direct investments (FDI) in Armenia has been steadily growing over the years, except for the spike in 1998 when the national telephone company (Armentel) was acquired by the Hellenic OTE firm. These tend to be relatively small, but have shown a very healthy growth pattern. In 2005, FDI stood at USD 258 million and made up about 7 percent of GDP (click here for a trend).

The Armenian statistical agency (armstat.am), in a recent release, reported FDI for the first half of the year to total USD 86.3 million, or 9.3 percent higher than that for the same period in 2005. Interestingly, more than 40 percent of the FDI took place in the telecom and air transport sectors which should go a long way in relaxing some of the constraints imposed by the land-locked geography of Armenia.

FDI by sector in 2006H1

Telecom 33.1%

Mining 14.3%

Air Transport 9.4%

Other 43.2%

The total foreign investment for the first half of the year was actually USD 178.5 million (27.9 percent growth over same period in 2005), of which 86.3 million is FDI. I guess the difference is dividend investment. But what is it invested in? How much of it is debt purchase, minority ownership in a corporation, and so on? The breakdown of this foreign investment is interesting. Lebanese investors, with about USD 50 million, lead the way. They are closely followed by Greece, and from a distance by Russia, Argentina, the US, and Germany.

Total Foreign Investment in 2006H1 (USD million)

Lebanon 49.6

Greece 37.9

Russia 19.2

Argentina 17.3

US 14.9

Germany 12.1

Other 27.5

Total 178.5

FDI 86.3

It is not clear how the recent destruction of its economy by Israel will affect future investments from Lebanon. Greece continues to play a critical role by its steady and sizeable investments in Armenia. Russia’s investments seem to be too low by any yardstick. Argentina has been on the radar screen for a number of years by its investment in the Zvartnots airport in Yerevan. US investors do not seem to have much of a presence particularly given the size of their economy. However, Germany has made its presence felt, particularly as it represented the largest export market for Armenian goods in 2005 (click here).

Does anyone have a time series of the FDI data by source (country) and sector? It will be good if this can be posted on the AEA website, unless available online elsewhere, so that it will be accessible to researchers. The Economy and Values Research Center in Yerevan has done some work on the role of the Diaspora. But besides that, is there any research done on their economic impact as well as the rate of return on such investments? Equally important, has any research been done, other than that by the World Bank, on impediments to such investments?

The Armenian statistical agency (armstat.am), in a recent release, reported FDI for the first half of the year to total USD 86.3 million, or 9.3 percent higher than that for the same period in 2005. Interestingly, more than 40 percent of the FDI took place in the telecom and air transport sectors which should go a long way in relaxing some of the constraints imposed by the land-locked geography of Armenia.

FDI by sector in 2006H1

Telecom 33.1%

Mining 14.3%

Air Transport 9.4%

Other 43.2%

The total foreign investment for the first half of the year was actually USD 178.5 million (27.9 percent growth over same period in 2005), of which 86.3 million is FDI. I guess the difference is dividend investment. But what is it invested in? How much of it is debt purchase, minority ownership in a corporation, and so on? The breakdown of this foreign investment is interesting. Lebanese investors, with about USD 50 million, lead the way. They are closely followed by Greece, and from a distance by Russia, Argentina, the US, and Germany.

Total Foreign Investment in 2006H1 (USD million)

Lebanon 49.6

Greece 37.9

Russia 19.2

Argentina 17.3

US 14.9

Germany 12.1

Other 27.5

Total 178.5

FDI 86.3

It is not clear how the recent destruction of its economy by Israel will affect future investments from Lebanon. Greece continues to play a critical role by its steady and sizeable investments in Armenia. Russia’s investments seem to be too low by any yardstick. Argentina has been on the radar screen for a number of years by its investment in the Zvartnots airport in Yerevan. US investors do not seem to have much of a presence particularly given the size of their economy. However, Germany has made its presence felt, particularly as it represented the largest export market for Armenian goods in 2005 (click here).

Does anyone have a time series of the FDI data by source (country) and sector? It will be good if this can be posted on the AEA website, unless available online elsewhere, so that it will be accessible to researchers. The Economy and Values Research Center in Yerevan has done some work on the role of the Diaspora. But besides that, is there any research done on their economic impact as well as the rate of return on such investments? Equally important, has any research been done, other than that by the World Bank, on impediments to such investments?

Friday, September 08, 2006

The Armenian IT Sector

The global market for western spending on IT services is about $50 billion (The Economist). It will be a major feat if Armenia were able to capture any portion of it, as many hope it will.

Much of the western Business Processing outsourcing is captured by India. China is far behind, but is gradually catching up. For instance, consider the city of Xian in Western China. The government, at a cost of USD 12 billion, is in the process of expanding a technology park to 90 sq km, housing 7,500 companies, supported by more than 100 universities with annual graduates of 60,000 in computer science alone (from the Economist).

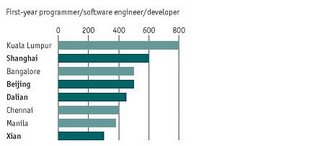

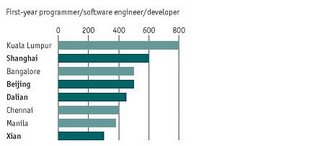

Given its size and development stage, can Armenia truly compete? Could western outsourcing represent a significant source of income to Armenians? A cursory look at the prevailing monthly salaries in Asian counties (below in USD, from The Economist), with over half the world’s population, should be a clear indicator of the limited potential of outsourcing to Armenia. Indeed, the IT sector in Armenia employed only 3,000 individuals in 2003, with annual salaries of about USD 5,000 for experienced developers.

Outsourcing is unlikely to contribute in any significant way to economic growth in Armenia. In all likelihood, the IT sector will expand with domestic opportunities, and the demand for it in the telecom, travel, hospitality, and healthcare sectors, as well as the growing accounting and business services. In turn, the IT sector will enhance the productivity of the Armenian economy. Today, for instance, it takes much less time to make a hotel reservation, or clear through immigration and customs at the airport in Yerevan then it did less than a decade ago.

I am sure there is some IT component in the export of services from Armenia. Are there any statistics on their magnitude or potential volume? Is Armenia a net exporter or importer of IT intensive services? Also, do we know much about the educational system and training available in Armenia, both at the technical and managerial levels?

Much of the western Business Processing outsourcing is captured by India. China is far behind, but is gradually catching up. For instance, consider the city of Xian in Western China. The government, at a cost of USD 12 billion, is in the process of expanding a technology park to 90 sq km, housing 7,500 companies, supported by more than 100 universities with annual graduates of 60,000 in computer science alone (from the Economist).

Given its size and development stage, can Armenia truly compete? Could western outsourcing represent a significant source of income to Armenians? A cursory look at the prevailing monthly salaries in Asian counties (below in USD, from The Economist), with over half the world’s population, should be a clear indicator of the limited potential of outsourcing to Armenia. Indeed, the IT sector in Armenia employed only 3,000 individuals in 2003, with annual salaries of about USD 5,000 for experienced developers.

Outsourcing is unlikely to contribute in any significant way to economic growth in Armenia. In all likelihood, the IT sector will expand with domestic opportunities, and the demand for it in the telecom, travel, hospitality, and healthcare sectors, as well as the growing accounting and business services. In turn, the IT sector will enhance the productivity of the Armenian economy. Today, for instance, it takes much less time to make a hotel reservation, or clear through immigration and customs at the airport in Yerevan then it did less than a decade ago.

I am sure there is some IT component in the export of services from Armenia. Are there any statistics on their magnitude or potential volume? Is Armenia a net exporter or importer of IT intensive services? Also, do we know much about the educational system and training available in Armenia, both at the technical and managerial levels?

Subscribe to:

Posts (Atom)